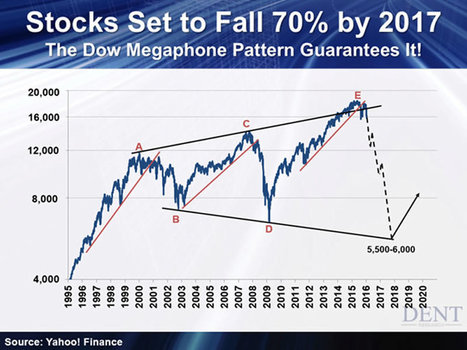

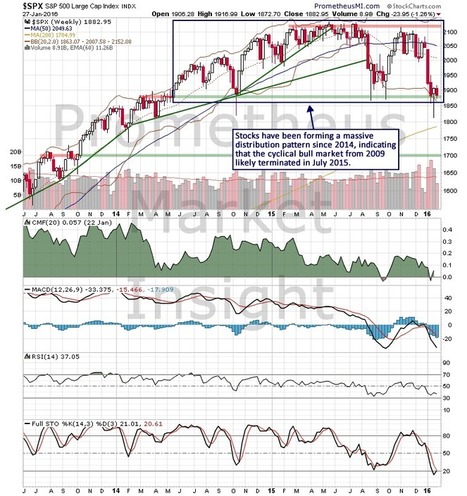

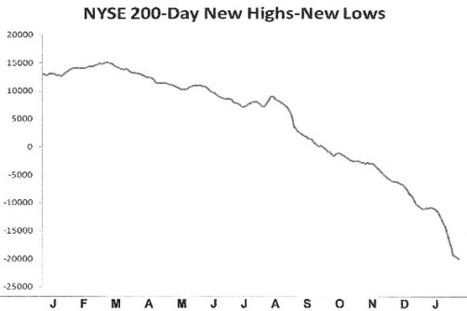

For those who follow market and economic cycles other than the traditional 8 year cycle and the 40 year super cycle which all point to some serious downside in 2016 the Kondratieff cycle suggests we have entered a major winter wave which has serious downside implications between 2000 and 2020. We are in the last leg of the down wave that usually has the most downside. The last major winter wave lasted between 1929 and 1949 and covered the Great Depression of the 1930's. Here is a summary from kondratieffwavecycle.com.

Eaton Vance Tax-Managed Buy-Write Income Fund (ETB) to Issue Monthly

Dividend of $0.11 on April 30th

-

Eaton Vance Tax-Managed Buy-Write Income Fund (NYSE:ETB – Get Free Report)

declared a monthly dividend on Monday, April 1st, Zacks reports. Investors

of re...

19 minutes ago