One-off attacks merely shift economic activity from one period to another; long-term campaigns are another matter"

If Japan’s economy is in trouble, you wouldn’t know it from the stock market."

Deciding how the economy will react to an expected rate hike is difficult. Here's how we can invest while waiting for the Fed's details"

Preferred shares can carry call risk or may have no final maturity.Investors can plan for the long-term yield from the shares, accounting for default risk, and avoid shares that trade at premiums to c..."

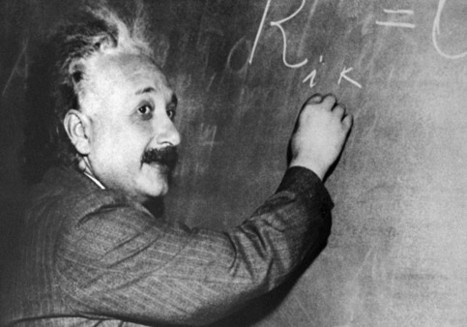

No matter what your age, or how much or little money you have, you can put one of Albert Einstein's insights to work for you. Compound interest, which was famously cited by Einstein as one of the wonders of the world."

With heighten speculation the Fed will raise rates in December, Cramer weighs in on why the Fed is the market's adversary."